Real Estate News

Big News for Slough by Berkeley Homes

Berkeley Homes, developer of the Horlicks Quarter, says it will take forward the existing proposals to deliver a high-quality, residential-led mixed-use development. Plans include new public realm, extensive landscaping across the site and a mix of new homes, community spaces, leisure facilities, and food and drink destinations – designed to reflect the needs of modern town centre living.

13 April 2025

Reading named one of the Best Places to Live by The Sunday Times

Reading has long been known for its strong corporate presence, with major players like Microsoft, Oracle, PwC, and PepsiCo calling it home. The recent development of Station Hill -a £750 million project -has further enhanced the town’s appeal, bringing high-end residential and office spaces, along with new entertainment and leisure options.

03 April 2025

Man Utd plan to build ‘iconic’ £2bn 100,000-capacity stadium

Manchester United have announced plans to build the biggest stadium in the UK – an “iconic” new £2bn 100,000-seater ground close to Old Trafford. Once construction is complete, the club’s existing home is likely to be demolished.

13 March 2025

Money Week

Bank of England expected to cut interest rates by 25 basis points. Markets are betting on an interest rate cut at the first MPC meeting of the year, bringing the base rate to 4.5%.

06 February 2025

Residential Roundup – 31 January

House prices rose 4.1% in the year to January 2025 according to the latest figures from Nationwide, down from 4.7% in December but still a higher annual growth figure than any other month in 2024.

03 February 2025

2025 housing market forecast: 5 things you need to know

Rightmove experts predict that average asking prices will increase by 4% by the end of next year, which, even though the largest growth we’ve predicted since 2021, is in-line with the long-term average.

15 December 2024

A significant rebound in British housing prices is expected.

Rightmove’s forecast for a 4% increase in asking prices in 2025 is the biggest since 2021, although it noted that this was “in line with average long-term price growth”.

15 December 2024

Interest rate cut for first time since 2020

The Bank of England (BoE) has announced it will reduce the Base Rate to 5% this month, a reduction of 0.25%, and the first cut in four years. The Base Rate had been held at 5.25% since August 2023, after 14 consecutive rises.

1 August 2024

JLL Residential Forecasts 2024-2028 update

JLL is updating its house price forecasts for 2024, with the latest projections suggesting a more positive outlook for the market.

Lower value markets are expected to outperform this year as higher mortgage rates persist. As rates improve, we expect London to lead the pack, with growth in both central and Greater London expected to be higher over the five year forecast period.

28 May 2024

Savills discusses brighter forecast for property market

As we enter what is traditionally the most popular time of year to buy and sell a home, it feels like the property market is beginning to warm up just in time for summer.

Underpinned by a slightly better than expected economic performance alongside greater stability in mortgage costs, buyer activity looks to be picking up.

26 May 2024

What does the Spring Budget mean for the housing market?

Chancellor Jeremy Hunt today laid out his Spring Budget. This comes after weeks of rumours around potential changes to stamp duty tax, and the possible launch of a 99% mortgage scheme.

However, while the speech made some announcements related to the housing market, they are measures that are likely to be relevant to only a small number of home-buyers and sellers.

06 March 2024

Residential Market Update March 2023 – Spring Budget Overview

Updated forecasts following the Spring Budget show the UK economy will now not not enter into a technical recession in 2023. However, it is still expected to see a small contraction of 0.2%. At present the UK inflation rate remains stubbornly high, however the Office for Budget Responsibility (OBR) has forecast inflation will fall to 2.9% by year end. Despite economic uncertainty, the labour market continues to rally. Although job vacancies have fallen there still remains over 300,000 more vacancies than there were at the beginning of the Covid pandemic.

17 March 2023

Financing Your First Home: A Comprehensive Guide for First-Time Buyers

At JLL, we understand that purchasing your first home is both an exciting and nerve-wracking process. It’s likely to be the biggest purchase you’ve ever made, and it’s important to get it right. One of the most significant factors in ensuring a successful home purchase is understanding how to finance it. In this guide, we’ll take you through everything you need to know to finance your first home.

03 March 2023

UK Residential Market Set to See Busiest Year in Over a Decade?

This rise is the highest in the past seven years.

Jun 02, 2021

Reuters house prices jump by 10.9% comparing with May 2020

Jun 01, 2021

UK Capital Markets 2020 Review and 2021 Outlook

March 05, 2021

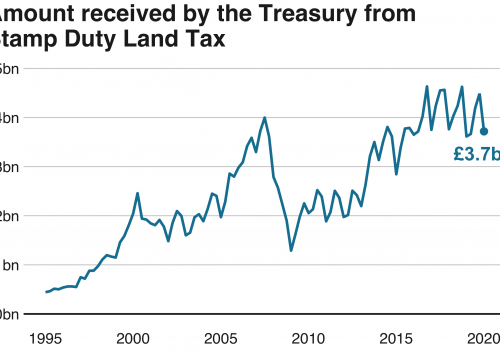

UK Non-resident Stamp Duty

UK Budget 2021: a good news for home buyers

Stamp duty holiday: The winners and the losers

The Salford-based university lecturer reckons the chancellor’s announcement on Wednesday will save her and her husband about £8,000.

“We’re in the middle of buying our £346,000 dream home and have agreed a completion date of 30 July.

8 July 2020

When does the Stamp Duty Holiday ends

Last summer, the government temporarily increased the amount at which stamp duty is paid to £500,000, for property sales in England and Northern Ireland.

The tax break was due to end on 31 March, but Mr Sunak announced in the Budget that it will now end on 30 June.

3 March 2021

Average London house price exceeds £500,000 for first time

The average price of a property in London broke through the £500,000 barrier for the first time, official figures for November show, with pent-up demand from lockdowns, a change in the types of homes being bought and two tax deadlines all fuelling the market.

20 Jan 2021

Rightmove experts predict that average asking prices will increase by 4% by the end of next year, which, even though the largest growth we’ve predicted since 2021, is in-line with the long-term average.

15 December 2024

- A'ayan Real Estate

- Consultancy Department

- P O Box: 2973 Safat 13030 Kuwait

- D: +965 22212100

- T: +965 22212121 Ext: 375

- info.consultancy@aayanre.com

Smart Target